【最新消息】5月1日起自动暂缓车贷Hire Purchase需额外手续!

国家银行4月30日发出文告表示,5月1日开始,所有暂缓还贷车贷Hire Purchase需要额外手续申请,所有借贷者将会收到各个银行的SMS/Email通知。

只需填写简单的表格即可继续享有自动暂缓还贷Moratorium长达6个月。

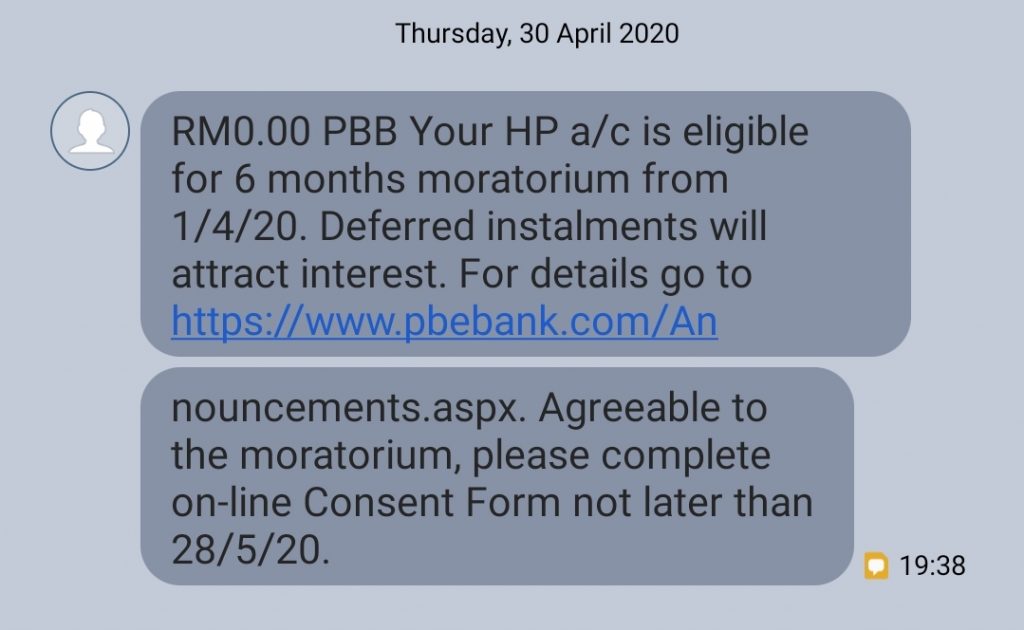

比如小编的车贷是和Public Bank大众银行的,已经收到SMS通知,只需到指定的银行页面填写表格即可。

其他银行也可到各大银行页面查看更多详情。

国家银行原文:

链接:https://www.bnm.gov.my/index.php?ch=en_press&pg=en_press&ac=5042&lang=en

Operationalisation of Moratorium for Hire-Purchase Loans and Fixed Rate Islamic Financing

Ref No : 04/20/04 30 Apr 2020 Embargo : For immediate release

Further to Bank Negara Malaysia’s (BNM) announcement on 25 March 2020, banking institutions are in the process of formalising agreements which reflect the revised payment terms with borrowers/customers with hire-purchase (HP) loans and fixed rate Islamic financing to give effect to the 6-month moratorium on loan/financing payments. This is to comply with the procedural requirements under the Hire-Purchase Act 1967 and Shariah requirements which are applicable to any changes that are made to the terms of these agreements, including changes to the payment schedules and/or amounts as a result of the moratorium.

In connection with the above, BNM has required banking institutions to take appropriate steps to ensure that borrowers/customers are provided with clear information on the process and changes to the terms of their agreements, as well as convenient means to conclude these agreements in view of the Movement Control Order.

Starting from 1 May 2020, borrowers/customers with HP loans and fixed rate Islamic financing will receive a notification via SMS, email or registered mail from their banking institutions on the necessary steps that they need to take to complete the process of deferring their loan/financing payments under the moratorium. Banking institutions will also provide to each borrower/customer specific details of changes to the terms of his/her HP loan or fixed rate Islamic financing agreement. This should contain information on the revised payment schedule and any changes to payment amounts, including those arising from normal interest/profit rate accrued during the moratorium.

Borrowers/customers who do not wish to take up the moratorium can still choose to do so at this time by informing their banking institutions and resuming their scheduled payments based on the terms of their existing agreements. In such a case, borrowers/customers will be given reasonable time by banking institutions to regularise any outstanding scheduled payments that were earlier deferred under the moratorium. Banking institutions will not impose overdue or late payment charges on these payments until they are due based on the revised payment schedule agreed with borrowers/customers.

Borrowers/customers are encouraged to refer to the websites, internet banking portals or call centres of their banking institutions for further information.

Bank Negara Malaysia

30 Apr 2020

© Bank Negara Malaysia, 2020. All rights reserved.